After a temporary halt to escalating tariffs, the focus of U.S.-China trade tensions has shifted to a critical resource: rare earth minerals.

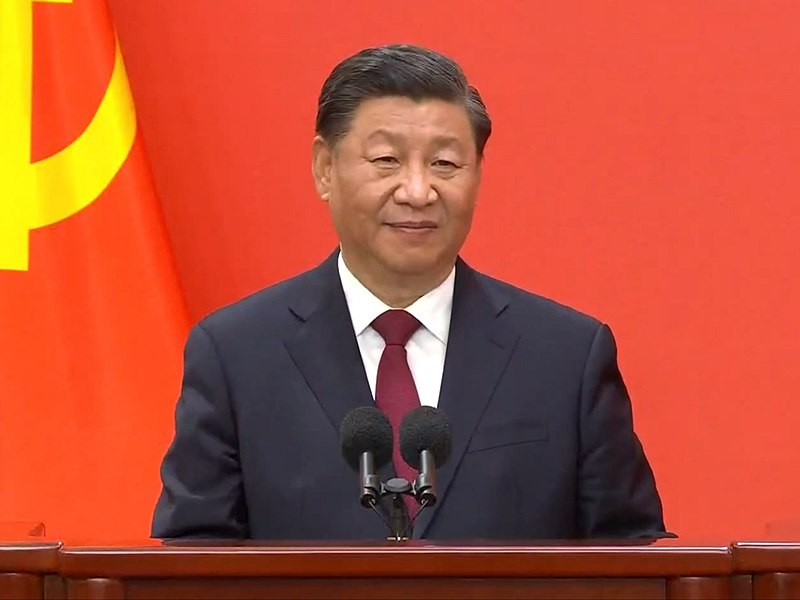

China has tightened export controls on these valuable minerals in response to U.S. tariffs. While Washington is eager to maintain access to China’s rare earth supply, Beijing sees its dominance in this sector as a powerful bargaining chip in ongoing trade negotiations.

The two nations reached a temporary truce over the weekend during a trade summit in Geneva. As part of the agreement, the U.S. will reduce tariffs on Chinese imports from 145% to 30%, while China will cut tariffs on American goods from 125% to 10%. Both sides described the deal as a step toward a broader trade agreement and announced the creation of a mechanism to support continued dialogue.

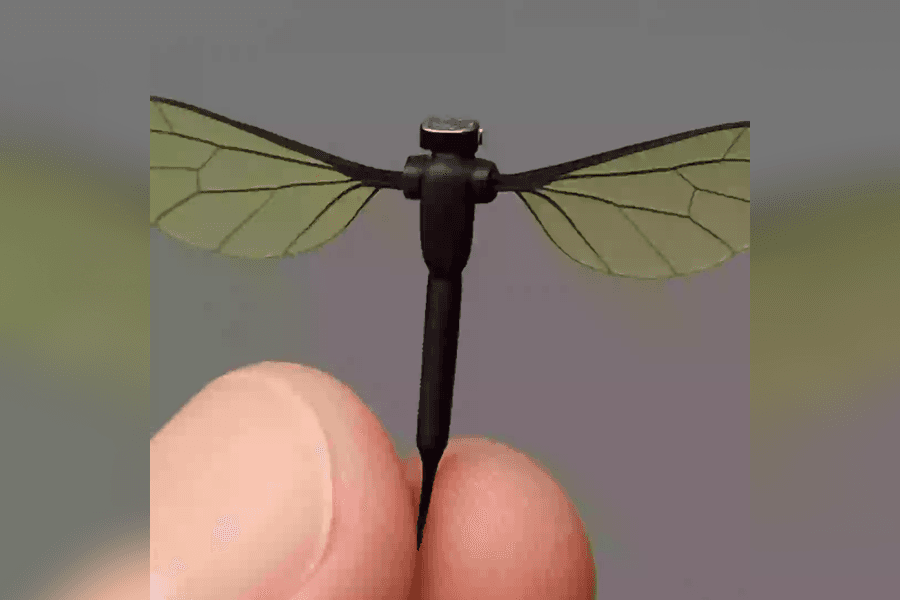

One major sticking point is China’s stranglehold on the rare-earth minerals market. These minerals are essential for advanced manufacturing — from electric vehicle batteries and smartphones to military equipment like radar and missile systems. With national security and economic interests at stake, rare earths have become a focal point in the broader trade conversation.

“Dominating this sector is one of China’s strongest forms of leverage,” said Dexter Roberts, a nonresident senior fellow at the Atlantic Council. He noted that China is unlikely to lift export restrictions any time soon. “They’ve already used rare earth controls to punish the U.S., and they’ll likely keep this tool in their economic arsenal.”

Following the White House’s announcement of new global tariffs on April 2, China imposed stricter rules on rare-earth exports, including a requirement that foreign buyers obtain licenses.

Despite the tension, China doesn’t aim to fully cut off the U.S. from these resources, said Jeorg Wuttke of the DGA-Albright Stonebridge Group. “The Chinese don’t want to close the door — they want to keep the pressure on.”

China’s rare-earth industry remains highly profitable. In 2024, exports rose 6% to 55,431 metric tons, even as their value dropped 36% to $488 million due to falling prices, according to Reuters. At the height of the trade dispute, however, production nearly came to a halt as tighter rules and rising costs disrupted global supply chains.

As negotiations continue, rare earths remain a sensitive and strategic issue — one that could shape the future of U.S.-China trade relations. Photo by N509FZ, Wikimedia commons.